Artificial intelligence has created the world’s biggest and fastest-developing tech skills shortage in over 15 years, finds a new Nash Squared/Harvey Nash report that has been tracking the views of technology leaders since the late 1990s.

The Digital Leadership Report, the largest and longest-running survey of technology leadership in the world, found that AI has jumped from the 6th most scarce technology skill to number one in just 18 months—the steepest and largest jump in any technology skills shortage recorded for over 15 years.

Almost twice as many technology leaders (51%) compared to the previous report (28%) now say they are suffering an AI skills shortage, an 82% jump. In the previous years that Harvey Nash has tracked technology skills shortages globally, the next biggest reported jump was a shortage in Big Data skills, with a jump of just 38%. Even with Cyber skills, for which demand continues to grow, the increase in scarcity has been gradual—rising from 16% in 2009 to 33% this year.

This rapidly developing AI skills shortage is closely linked to a significant growth in investment, with 90% of global technology leaders now reporting they are either piloting AI or investing in small- or large-scale developments. This has skyrocketed from 59% in the previous Digital Leadership Report. Despite this steep rise, over two thirds (67%) of all technology leaders report they have not received measurable ROI from piloting AI. Larger organizations, however, fare better in quantifying results: more than half (53%) of larger organizations with technology budgets exceeding $500 million report a measurable return.

Although AI investment has helped create this tech skills shortage, technology leaders and their companies still are working on how to respond to the crisis, as the report found that over half of companies (52%) are not upskilling in GenAI. But it is not just a skills question: operating models will also need to change as the tech team is increasingly supplemented by AI and activities like software development are revolutionized.

“As HR leaders work through this changing AI landscape, the future of hiring means rethinking which skills are needed and how teams are structured to fully harness AI’s potential,” says Jason Pyle, president of Harvey Nash USA and Canada. “The Nash Squared/Harvey Nash Digital Leadership Report found that the organizations with large-scale implementations of AI are 24% more likely to increase their tech headcount, so HR should be prepared for that swing as AI adoption grows. Leaders are using AI to drive growth in ways previously unattainable, and HR will play a pivotal role in shaping talent acquisition strategies to meet these growth goals.”

AI Shaping Investment Decisions

Overall, as with other business functions in uncertain economic and geopolitical times, the outlook for technology budgets has dipped from the highs seen during and after the pandemic—but still, over a third (39%) of technology leaders expect their budget to rise. Investment has become more selective. Boards are most attracted to clear business cases tied to operational efficiency and AI-powered growth.

The organizations most ahead with large-scale implementations of AI are 24% more likely to be increasing their tech headcount than their peers, mostly in areas of AI and data. Tech leaders expect one in five of their technology jobs to be fulfilled by AI in the next five years. But the Nash Squared/Harvey Nash report highlights that AI isn’t replacing people, it’s changing the kind of people leaders want to hire and their operational models.

Almost two thirds (65%) of tech leaders would choose an AI-enabled software developer with just two years’ experience over one with a five-year career but without AI skills.

Organizations that engage with Gen Z are making more progress in AI. Compared to the global average, organizations that attract, retain, and incorporate the viewpoints of Gen Z are twice as likely to be prepared for the demands of AI and one-fifth more likely to report a measurable ROI from AI.

“Gen Z has grown up with AI at their fingertips, so it’s no surprise they’re more comfortable – and less intimidated – when it comes to using these tools. That ease is a real asset in the workplace, as they’re not just using AI, they’re leveraging it strategically and enthusiastically to boost everyday productivity,” Pyle says.

Demand up for Cyber Skills

After a period of decline, cyber-attacks have once again increased, and the skills demand has grown in response (up 22% since the last report).

With software development the most widely adopted use case for AI, it appears to be plugging a skills gap that has long been a challenge to recruit. Software engineer shortages dropped 26% since the last report.

The growth in agile methods—as well as the use of cloud technologies—has decentralized project delivery and reduced the need for heavyweight roles in enterprise/solution architecture.

Major cyber-attacks are rising again – 29% of tech leaders were subjected to a major attack in the last two years, the highest level since 2019 (32%) and breaking a downward trend in the last five years. Threat from “foreign powers” and “insiders” rises steeply – While organized crime remains the primary cause for concern, there has been significant growth in the threats from foreign powers (40% in 2022 to 50%) and insiders (33% to 42%).

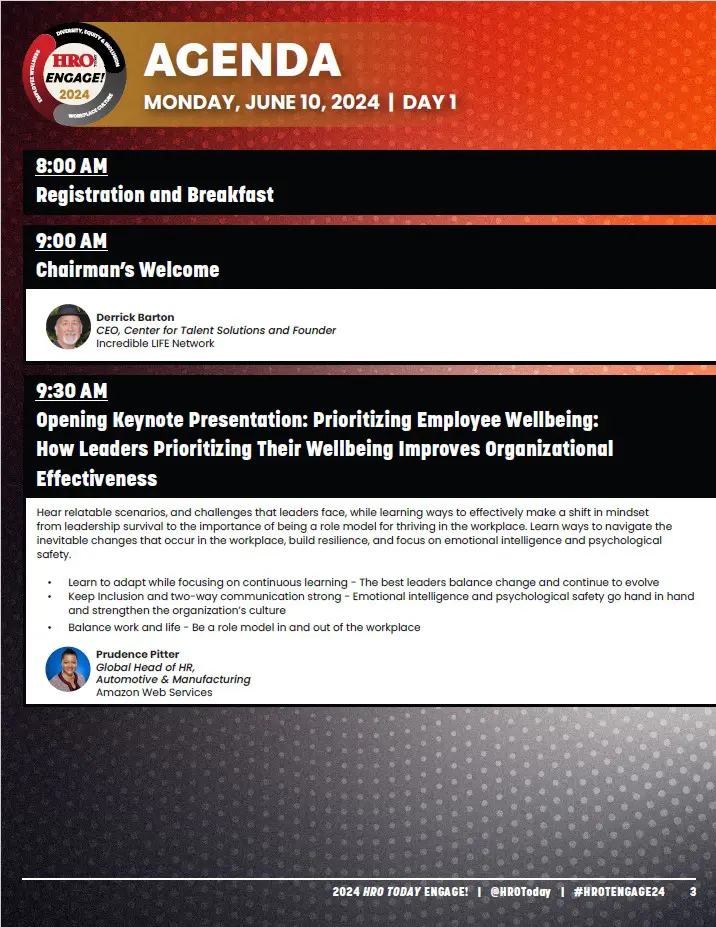

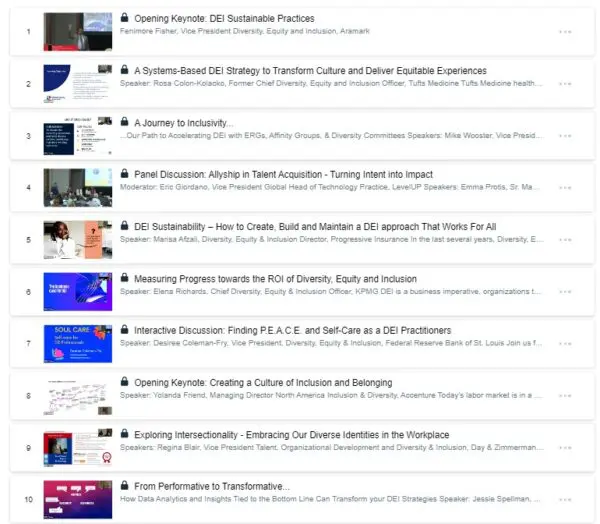

DEI Progresses as Gender Parity Flatlines

DEI efforts remain strong despite shifting political winds – Globally, four in ten organizations have ramped up their DEI focus over the last two years, and very few tech leaders report a reduction in DEI. Around one-fifth of a tech team could be considered neurodivergent, and nearly half of leaders (47%) have practices in place to support neurodivergent talent.

Progress on gender is stuck – Just 23% of tech teams are women—the same as two years ago. Women in leadership have dropped from 14% to 13% since the last report.

Over half of tech leaders have had a salary rise in the last year, but for four in ten, pay has remained static. Tech leaders that have had a pay rise of 10% or more are distinct – Firstly, their CEO is significantly more focused on technology making money instead of saving it for the organization (73% compared to the 66% global average.) They are also more likely to have a large-scale implementation of AI (27% versus 19%) and more likely to increase tech headcount (50% versus 41%).